India’s energy usage pattern undergoing rapid change. Rising use of electricity and gas will improve efficiency and strengthen energy security.

Pratim Ranjan Bose

Post On > Jan 11 2022 2249

Rapid progress in electrification; the boom in the electric vehicle (EV) segment; and the creation of the gas-pipeline network, across the country; may replace a significant portion of India’s liquid fuel consumption over the next decade. The trend is already visible in declining diesel consumption by Indian Railways.

The gains will primarily come through diversification of energy basket; optimal use of domestic energy sources, be it coal, renewable or trapped gas (in the northeast); optimal utilization of manufacturing potential; maximum value addition; job creation and; hedging against geopolitical risks, which are integral to the global energy landscape.

Railway track electrification

The fast-changing energy preference of the Indian Railways is clear proof of the new reality. In 2014, railways contributed 3.24% of India’s total domestic consumption of 68.3 million tonne (2013-14) of high-speed diesel (HSD). The share was down to 1.26 mt or 1.73% of the total consumption (72.7 mt) in 2020-21.

True, 2020-21 was not an ideal year, as passenger train services were disrupted for a substantial period due to covid related restrictions. However, a closer look will reveal, India’s total diesel consumption stagnated at around 82 mt for three years preceding the pandemic.

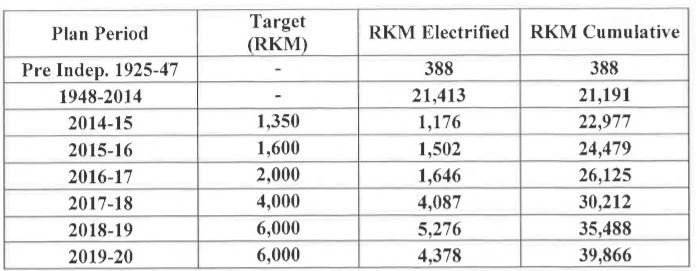

Fast progress in railway track electrification is a clear reason behind the change in consumption patterns. At the time of Independence, India had 388 km electrified routes (Route-km or RKM). The share rose to 20,000 RKM or 33% of the total as of March 31, 2010.

Railway Track Electrification (Route kilometre)

(Source: Ministry of Railways)

As in 2014, when the incumbent Narendra Modi government took over, 21191 route-km was electrified. As of March 31, 2021, nearly 71% (45881 RKM) rail routes were electrified. Clearly, more routes were electrified in the last decade than ever.

In 2020-21 alone railways electrified 6015 route km (13% of electrified RKM), taking advantage of thinner traffic due to covid. The target is to reach full electrification by December 2023. Going by the progress so far, there is little doubt that the target will be achieved.

While some consumption of diesel, to run peripheral services, cannot be avoided; it is safe to assume that the ‘lifeline of the nation’ will soon meet 90%-95% of its energy demand through grid power.

From diesel to petrol

Erosion in railway business apart, the other reason impacting diesel sales is demand displacement from diesel to petrol, particularly in private car and utility vehicle (UV) segment.

A 2014 study by Nielsen (India) Pvt Ltd for Petroleum Planning and Analysis Cell (PPAC) of Petroleum Ministry showed 70% of Diesel, 99.6 % of Petrol consumed by Transport Sector.

Of the total diesel sales, 13.15% was consumed by private cars and UVs, 8.94% by commercial cars and UVs and 6.39% by 3-wheelers. Trucks account for 28.25% and Buses 9.55%. Agriculture Sector uses 13% of Diesel; industry consumes 9.02% including industry gensets with 4.06% and Mobile Towers 1.54%.

The study was conducted during the UPA rule when diesel prices were hugely subsidized. The brunt was primarily borne by the oil companies, the government shared a part of it through the issue of very long-term oil bonds to the companies.

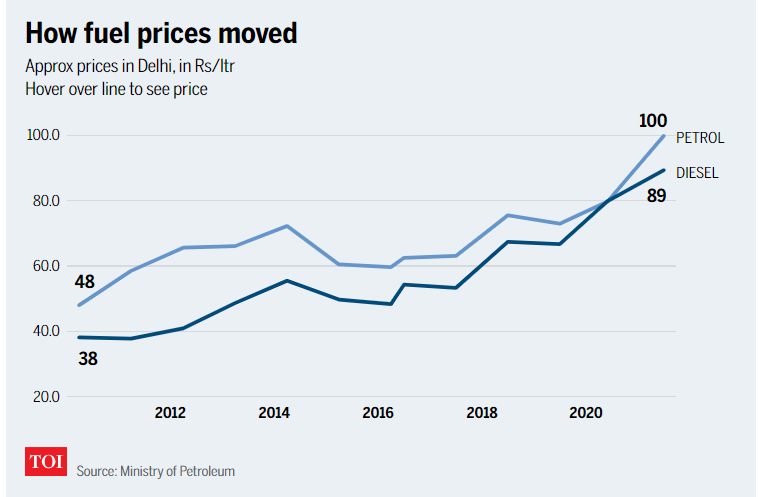

As in 2012, diesel was cheaper by Rs 28-30 a litre compared to petrol (which was sold at around Rs 70 a litre). The high cost-arbitrage worked in favour of diesel cars.

With diesel variants of almost every model available at Rs 1-1.5 lakh extra (in small and mid-segment) and a wide gap in prices of fuels; the balance tilted for diesel cars. The gains were higher in the fuel guzzler sports utility vehicle segment.

The subsidy which was supposed to go to the commercial vehicle segment (to keep inflationary pressures at check) was enjoyed by the rich, driving around in diesel Mercedes.

The Modi government deregulated the oil prices in 2014. Additionally, the rollout of stricter pollution control norms (BS-VI) made diesel cars a costlier proposition. Many or most companies stopped diesel car manufacturing in small and mid-segment.

According to ‘Times of India’ from 54% in 2012, the share of diesel cars in annual auto sales was down to 55% in 2015 and 18% in 2021. Share of petrol in new cars went up from 41% to 75%.

Only a fresh study can tell, what is the current share of diesel consumption in the private car segment. But visibly it is down and will go down further as the old cars are replaced.

Petrol to EV

Petrol sales in the country zoomed over the last seven years, up from17 million tonne in 2013-14 to 29.9 mt in 2019-20. There are strong reasons to believe that electric vehicles (EV) will cause a major dent in petrol sales, in a span of five to 10 years.

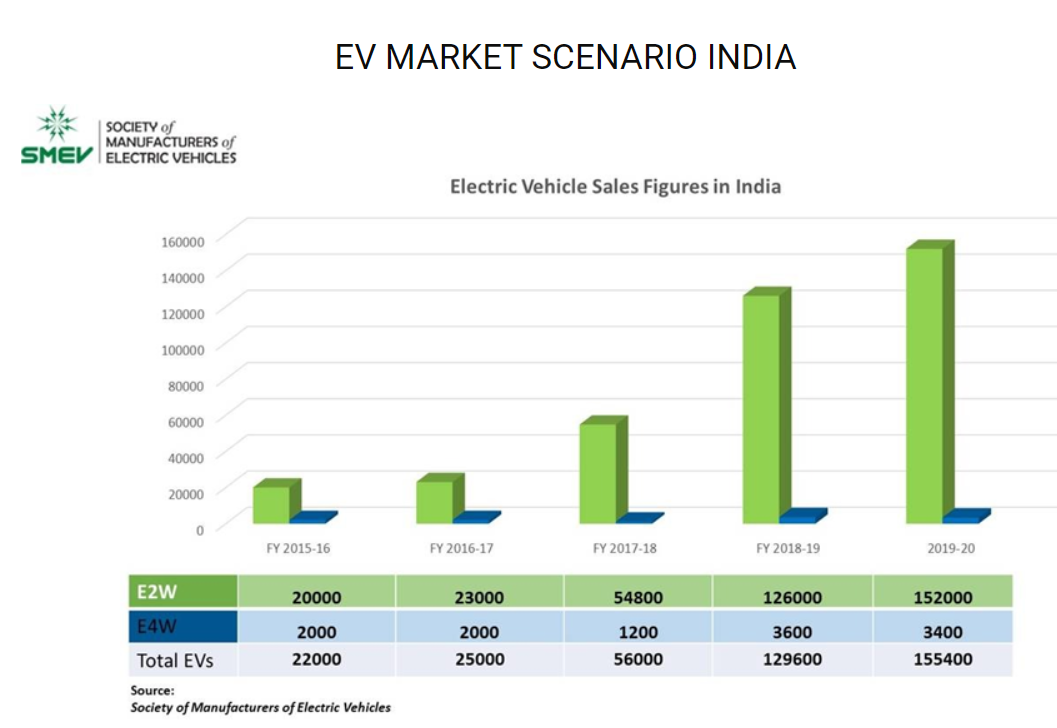

In 2014, two-wheelers topped petrol consumption with 61.42% followed by cars with 34.33% and 3-wheelers with 2.34%. The shift of cars from diesel to petrol may have changed the tally a bit in 2021. But EVs, particularly the EV two-wheelers, can invite bigger change in this segment in the next five years.

EV sales accounted for barely 1.3 per cent of total vehicle sales in India during 2021. According to JMK Research, 48.6% of EVs sold are two-wheelers, 41.7% are three-wheeler passengers, 4.3% are three-wheeler cargo, cars 5% and Bus 0.4%.

(This is excluding the unregistered battery-operated slow-speed four-wheel rickshaws playing a big role in passenger movement in urban areas across the country.)

With favourable policy push, the popularity of EVs is increasing exponentially. According to the Society of Manufacturers of Electric Vehicles (SMEV), about 234,000 units were sold during the year compared to just about 100,000 units sold a year ago. Monthly sales zoomed by three times from nearly 15,000 in December 2020 to 51,000 in December 2021.

The drivers to this mind-blowing growth are not difficult to understand. Leaving some pockets (comprising 0.01% of total) apart, almost all Indian villages now have access to electricity, up from barely 44% in 2001.

Alongside the access to electricity, the reliability of the power supply improved manifold. The generation capacity was doubled during the UPA era. The incumbent Modi government made way for huge investments in the transmission and distribution segment.

According to a recent statement by the government to Parliament (Economic Times, August 5, 2021), the average power supply per day was 22.17 hours in rural areas and 23.36 hours in cities during June 2021. As per independent surveys, the availability of power in rural areas has gone up from an average of 12 hours in 2015-16 to 20.50 hours in the year 2020.

Availability of electricity and high price of petrol (ruling above Rs 100/ litre in Kolkata for many months now) are pushing EV sales. There are many projections on future growth in this segment, ranging from 26% CAGR to 90% CAGR. Some expect EVs to occupy as much as 30% of the two-wheeler market in 2030.

Without getting into this debate and drawing inspiration from the fast popularity of mobile telephones (once considered a rich man’s toy); one can safely assume that after nearly two decades of experiments and wait, EV has caught the fancy of customers. It’s a matter of time before they dominate the road space.

Gas and industrial demand

Refiners consider diesel a safer bet (to petrol) due to dominant use in trucking, commercial, agriculture and industrial segments.

It is expected that a reliable supply of electricity replaced part of the demand from agriculture since 2014. The future developments in this segment will depend on the reliability of the power supply.

Until battery technology improves considerably, electricity cannot be a solution to heavy tonnage vehicles that includes trucks, dumpers, earthmovers, port equipment etc.

However, gas can potentially replace part of the demand. In a pilot project, Coal India Ltd (CIL) recently retrofitted two of its 2500 dump trucks with LNG kits. LNG hybrid high-capacity mining trucks are already in use in the US, Canada, Mexico and Russia.

The move is timed with the construction of the LNG terminal in Odisha and gas pipelines connecting eastern Indian States of Jharkhand, Odisha, West Bengal and Bihar. Jharkhand and Odisha are major mining destinations for coal, iron ore, bauxite, (aluminium) etc.

Mining is highly energy-intensive. CIL alone spends approximately Rs 3500 crore annually on liquid fuel. It is to be seen if LNG hybrid high-capacity mining trucks - which are already in use in many countries – can address the woes of miners in India.

Not only diesel, but gas may also replace part of the demand for other liquid fuels used in industry. The final usage pattern will depend on environmental restrictions, availability and cost dynamics. Industries in Gujarat, for example, switch between fuel oil and gas to ensure the least cost of production. The option will now be available to the manufacturing sector in the East.

The manufacturing sector is gearing up to tap the opportunity. Two fertilizer plants were reopened. Two more are under construction. Three of them are built by the central government, replacing closed naphtha-based facilities. The other one is in the private sector.

Gas will bring many surprises. The full impact will be known once the pipeline and Odisha terminal is complete.

Preparations are already underway to replace part of the LPG (liquefied petroleum gas) demand in large urban markets with piped gas. This is largely for operational efficiency as both gas (regasified LNG) and LPG supplies in the region, are imported.

Conclusion

The broad directions of the energy market in India are more or less clear. How they will take shape in the next 10 years will depend on policy focus, technological developments (particularly in battery space) etc.

It would be incorrect to see these developments through the prism of import substitution. Assuming India’s liquid fuel requirement will go down, the excess capacity will be used in exports. Moreover, expansion of gas and EV and renewable energy economy will lead to another set of imports. Imported gas will help us cut imports in fertilizer.

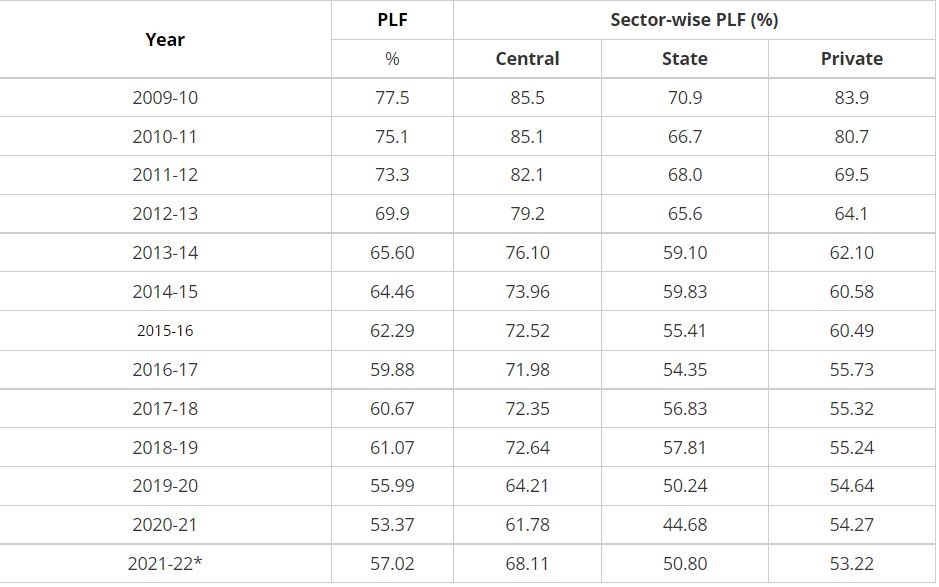

The economic gains will come through value addition. India created huge thermal power capacity, which was crucial for a reliable supply of electricity, during Plan-XI (2007-12) and Plan-XII (2012-17).

This helped create an excess capacity scenario as is evident in the falling plant-load factor in the thermal segment. Over and above the Modi government brought massive renewable (RE) focus. Greater use of grid electricity is helping India create demand for the generation and domestic coal mining sectors.

The PLF in Coal & Lignite based capacities from 2009-10 to 2021-22

The focus on EV and RE are further helping India in attracting investment in the manufacturing sector through the recently launched production-linked incentive (PLI) schemes. Full electrification will help improve Indian railways to speed up (by preventing loss of time in loco replacement). The nation will gain in terms of logistics efficiency.

In a world of disruptive technology, policymakers need to take a degree of risk to help nations grab emerging opportunities. This is the model business follow. India in the past wanted to be sure before making any move and lost many opportunities in the process.

With risk-taking comes risk mitigation. The huge dependence on liquid fuel, particularly for mobility, left India at the mercy of the crude oil market, where prices are determined by a few. Greater use of electricity in mobility will help the country mitigate part of the risk and ensure energy security.

*Pratim Ranjan Bose is a public policy expert. Views expressed are his own.

**Photo by Nikola Johnny Mirkovic on Unsplash

Reference:

- Petroleum Planning and Analysis Cell (PPAC) of Petroleum Ministry.

- Official websites of ministry of power and Railways.

- “How Diesel lost to petrol and petrol could lose to electric - one day”, Times of India, October 14, 2021. https://timesofindia.indiatimes.com/business/india-business/how-diesel-lost-to-petrol-petrol-could-lose-to-electricone-day/articleshow/86987265.cms

- JMK research and Analysis. EV Monthly Updates, Dec 2021 https://jmkresearch.com/wp-content/uploads/2022/01/EV-Monthly-Update_Dec-21_final-1.pdf

Northeast Energy Scenario Part-1: Paradigm shift in petroproduct availability and consumption

2023-03-28 16:22:05

Consolidation of 'indigenous' votes aligned Tripura's political landscape with the rest of the northeast.

2023-02-16 08:51:53

Why Kolkata doesn’t have a Unicorn ?

2023-01-28 09:53:57

Social media literacy should be mandatory in UG curriculum

2022-11-30 12:00:53

India's new CDS, Gen Anil Chauhan has a daunting task ahead!

2022-09-30 10:34:59

Make annual BBIN summits a norm, create a common market for food and services

2022-08-13 10:39:02