Infrastructure will attract investments to northeast : S K Barua, MD, Numaligarh Refinery

Post On > Jan 18 2022 3242

Until a few years ago, the 3-million tonnes per annum (MTPA Numaligarh Refinery Ltd (NRL) of Assam had a frustrating existence. There was not enough crude in the northeast to support the regional refining capacity of 7 MTPA. Regional demand was not adequate and poor infrastructure made exports unremunerative.

Regional demand is a factor of population and economic activity, which cannot go up overnight. There is no likelihood of any major increase in crude production in the region. Yet, NRL is now expanding its capacity to 9 MTPA, exporting products by rail to Bangladesh and laying a 130 km long oil pipeline from Siliguri in West Bengal to Parbatipur, a sub-district in northern Bangladesh.

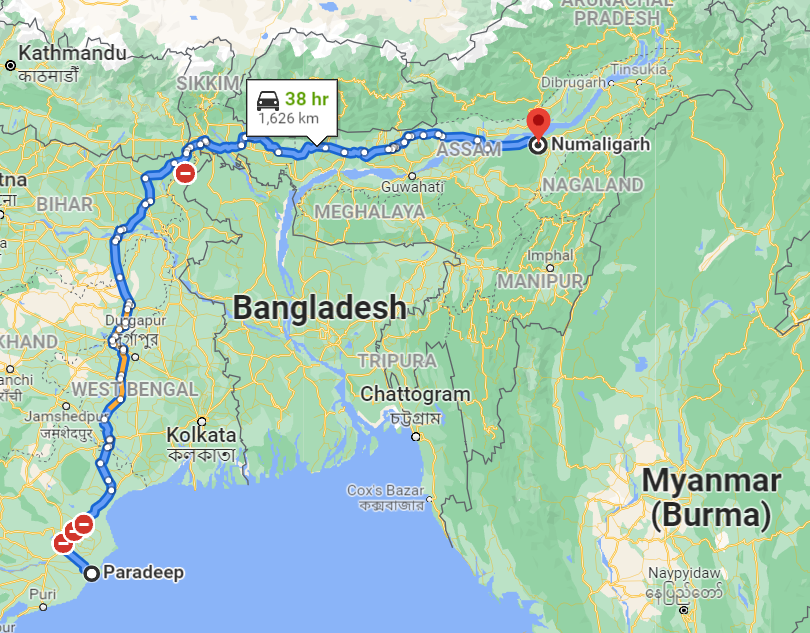

Not only NRL; the refining capacity of the region will soon be doubled from 7 to 15 MTPA riding on (imported) crude supplies from the Paradip port. A pipeline is under construction to make the northeast a refining hub. Meanwhile, a massive infrastructure rush is underway to remove the barriers that hinder the growth of this land-locked region and restore its status as a prosperous economy.

Iravati Research and Communication Centre (IRCC) launched the India@2022 discussion series to understand the readiness of the country to achieve the next level of growth.

As part of the initiative, our advisor Pratim Ranjan Bose recently met S K Barua, Managing Director of NRL. A prominent name in India’s oil and natural gas industry, he is playing a key role in giving shape to North-East Hydrocarbon Vision 2030.

In a free-wheeling discussion – that ranged from infrastructure, IT, Start-up to oil and gas - Barua explained the growth prospects of northeast India and the weaknesses it should address.

IRCC: Mr Barua, before we get into your preferred subject of oil and gas, here is a broad question on North-East. The region has attracted a lot of policy attention for the last two decades, particularly on the infrastructure front. The speed of project implementation has been distinctly faster in the last few years. Where does northeast stand now? How much ground did it cover?

Barua: About roads and highways, the connectivity in the region improved significantly in the last 7-8 years. Even Arunachal Pradesh now has a fair share of good roads, which was unthinkable in the past. Rail services are improving. It cannot be spread across the region due to (hilly) terrain. But State capitals are being connected.

A crude pipeline is being laid from Paradip to Numaligarh, via Guwahati and Bongaigaon. It will make Northeast a refining hub. The gas grid is under construction.

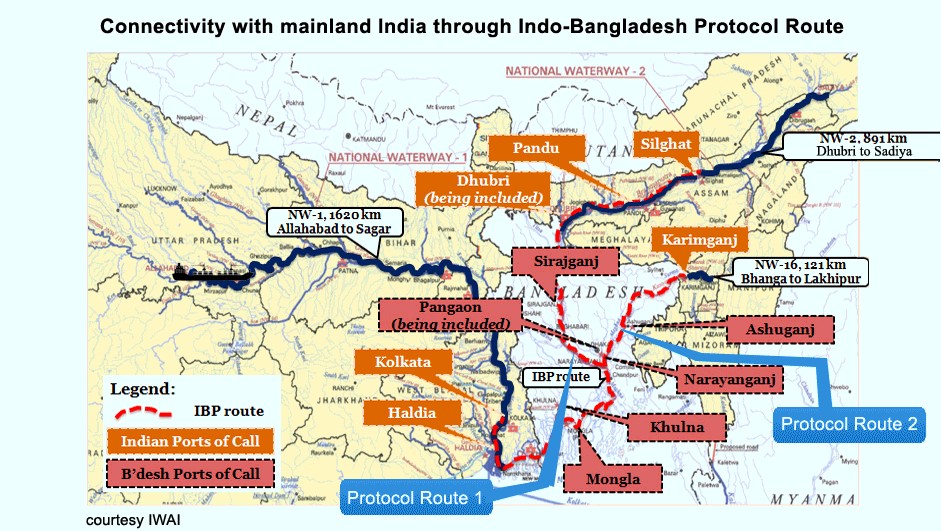

Completion of the Jal Marg Vikash (National Waterway development) project should open cheap transportation opportunities. From Pandu river-port in Guwahati, goods can travel down to Kolkata through Bangladesh. At NRL we plan to use this option in a big way.

Infrastructure is a game-changer. The progress so far has started yielding results. Assam is now growing at 8%. Activities have increased in smaller States in the region as well. Once these infrastructures are in place, the northeast will be free from the disadvantages of being landlocked.

IRCC: In the past, we have seen incentive-based investment in manufacturing in the North East. Companies, using imported raw materials to sell products mostly outside the northeast, had set up plants in Assam. Do you think this model (for attracting investment) is sustainable?

Barua: Incentive is provided to attract manufacturing. Some of these facilities like Dabur and Patanjali have started local sourcing of raw materials. Patanjali unit is probably their largest. Manufacturing, if not limited to blending and packaging, will have a positive impact on the local economy. Assam is an agriculture-based economy so there is a lot of scope for agri-based industries.

IRCC: India is witnessing a start-up led innovation boom, primarily riding on the IT sector. North-East has special vehicles to fund start-up initiatives. NRL too offered to incubate some. How is the achievement so far?

Barua: From a national perspective, so far the start-up revolution is largely IT-oriented. Assam and North East have a lot of ground to catch up in IT. However, we are having many non-IT start-ups from the region.

Both the central and Assam governments have windows to promote start-ups in the region. At NRL we created a Rs 10 crore fund to promote start-ups. Rs 6 crore of it is already disbursed and we got board approval for another Rs 30 crore funding.

Initially, we were providing the fund as a grant. Now we are planning equity participation in promising ventures. The private sector is already taking advantage of start-up led innovation and we cannot miss that bus.

Some of these start-ups are indeed doing a great job. At NRL we are implementing a project to produce ethanol (for blending with liquid fuel) from bamboo. A start-up will supply us with bamboo tissues.

IRCC: But, how will you negotiate the compliance issues in a PSU, like CAG audit and so on, and the freedom that a start-up innovator demands?

Barua: The PSU compliance procedures are a problem. But, we don’t want to miss the bus of start-up revolution. We have decided to make equity investments in start-ups even at the cost of extra compliance.

IRCC: NE Hydrocarbon Vision 2030 was released in 2016. Building pipeline networks for crude, petroleum products and gas was the focus area of this initiative. What is the implementation scenario? How will it help the North-East optimize its potential?

Barua: I have already mentioned the crude pipeline from Paradip. This will convert North East into a refining hub.

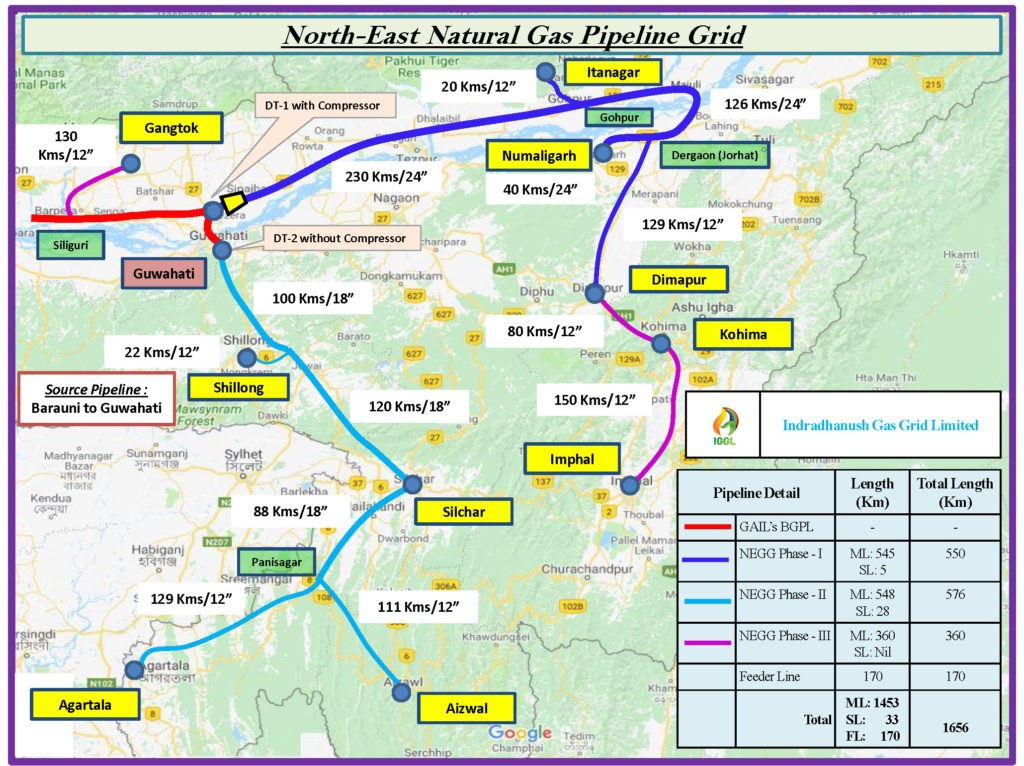

GAIL is implementing the Barauni (Bihar)-Guwahati (Assam) trunk gas pipeline project. This will connect the region with the Jagdishpur (UP)-Barauni (Bihar)-Sindri (Jharkhand)-Haldia (West Bengal) leg of the under construction national gas grid (Urja Ganga).

Indradhanush Gas Grid Ltd (IGGL), of which NRL is also a shareholder, is building a regional pipeline network covering eight northeastern States including Sikkim.

Gas will bring wide opportunities to the region in terms of fuel options. If pricing is correct, I am sure many industries, like tea factories, will prefer to move to cleaner fuel.

IRCC: Isn’t long pipeline transfer of crude costly? How will it augur for the refining sector in Assam vis-à-vis the anticipated negative impact of electric vehicles on auto-fuel sales?

Barua: Pipeline transfer of crude is costly. But it will offer a wider opportunity to switch production from diesel to more value-added petrochemical products. At NRL we primarily market in Northern West Bengal, Bihar and UP. Our internal assessment suggests despite the EV boom, demand for diesel will remain.

IRCC: How about export opportunities for petroleum products? How is NRL doing in exports?

Barua: NRL has already acquired a 15% market share in the Rangpur area of Bangladesh. The pipeline is likely to be commissioned next month. This will give us more handle.

Bangladesh is a fast-growing country and we are extremely bullish on it. At this juncture, our opportunities are limited to Northern Bangladesh, which is behind the Dhaka region in terms of opportunities.

The Bangladesh government wanted NRL to set up a few petrol-diesel pumps in the Rangpur area. We are considering the proposal. However, the Bangladesh market is not entirely free and there are a lot of government interventions, which is a cause of concern for us.

Infrastructure was a major constraint for refiners in the northeast to tap export opportunities in bordering economies, in the past.

NRL tried exporting products through the Moreh (Manipur) gate to western Myanmar cities. However, road movement from Numaligarh to Moreh through the hilly terrain was costly.

The landed cost of our products at Tamu (the border town of Myanmar opposite Moreh) was higher than Chinese supplies.

Now IndianOil is planning to set up a product pipeline to Moreh. This will help refiners tap export opportunities in Myanmar. Also, the government recently ordered a survey for the Imphal-Moreh rail link.

IRCC: Northeast is now a net importer of goods and services with limited products and services to offer to the rest of the country or outside the country. Considering the huge investments in the infrastructure sector, how do you expect the region to shape up in 2030?

Barua: Infrastructure, connectivity create opportunities. For example, with improved air connectivity in the region, we can sell more products to airlines.

Lack of infrastructure was the prime roadblock for growth. Remove that, and the region will flourish. The Northeast is good at English education. Improved infrastructure, including the digital infrastructure, can open opportunities in the IT and ITeS sectors.

My prescription is simple: Build infrastructure and the region will not require incentives.

123

2025-07-27 20:33:14

asd

2025-07-27 20:31:39

Northeast Energy Scenario Part-1: Paradigm shift in petroproduct availability and consumption

2023-03-28 16:22:05

Consolidation of 'indigenous' votes aligned Tripura's political landscape with the rest of the northeast.

2023-02-16 08:51:53

Why Kolkata doesn’t have a Unicorn ?

2023-01-28 09:53:57

Social media literacy should be mandatory in UG curriculum

2022-11-30 12:00:53